Starting a new series on quick notes from the QIP Placement Document shared by the companies. We find this document to be more detailed in comparison to the Annual Report. The most detailed document is the DRHP but that comes out only for new listings.

This is not a Buy/Sell Recommendation. We may only post on companies we track.

All QIP documents generally updated on this link –https://www.bseindia.com/corporates/qip.aspx

Control Print – QIP Placement Document

Business

· Company is one of India’s leading Coding and Marking solutions provider for printing variable information such as batch numbers, manufacturing and expiry dates, maximum retail prices, serial numbers, special markings, logos, company names and barcodes

· Vertically integrated company, involved in the development, research, manufacturing, marketing and commercializing of printing machines, spare parts, consumables (fluids) and associated services

About Industry - Coding & Marking

· Industry growth is closely co-related to packaging industry growth and the manufacturing sector growth as a whole

· Dominated value-wise by 4 players (Videojet Technologies, Domino Printech, Markem-Imaje India and Control Print) with our Company being amongst them

· Consistent growth of 15%+ over the last decade and is estimated to grow at similar rates approximately 10-15% revenue growth in the near future

· North America accounted for the largest market share of approximately 31% of the global market in 2016

· China, Japan, and India are three top countries contributing towards highest market size in the Asia Pacifc region

· Worldwide Coding and Marking market can be segmented on the basis of technology

(1) Continuous Ink Jet Printer (CIJ)

(2) Piezo Ink Jet Printer (PIEZO)

(3) Print and Apply Labelling Products (PALM)

(4) Thermal Ink Jet Printer (TIJ)

(5) Thermal Transfer Overprinting Printer (TTO)

(6) Valve Jet Printer (VIJ)

(7) LASER

· Continuous inkjet (CIJ) coding is presently the most preferred technology in the global coding and marking system market due to its ease of installation

· Indian Coding and Marking industry is estimated to be worth 1000 crores.

Products

· Continuous Inkjet Printers (CIJ)

· Drop-on-Demand Valvejet Printers (LCP)

· Thermal Transfer Over-printers (TTO)

· Thermal Drop-on-Demand Inkjet Printers (TIJ)

· Laser Coders

· Thermal Ink Coders

· High Resolution Piezo Drop-on-Demand Inkjet Printers (HR) and

· Related consumables and spares.

CIJ printers have been growing at a stable rate of 7-8% annually. However, increasing adoption of TIJ, TTO, and LCP printers is expected to drive the industry growth higher

Manufacturing Facilities

Two manufacturing plant across India, one at Nalagarh, Himachal Pradesh (37,316 sq ft), and other at Guwahati, Assam (65,000 sq ft) and One Research & development centre at Vasai Maharashtra (4500 sq ft).

Production Process

· Pre-dominantly an assembly process starting from the semi-fnished goods (SFG), followed by the assembly of printers and the testing procedure before dispatch of the printers

· Production of SFGs

· Production of Printers

Ø 1st Stage/Housing Assembly

Ø Final Printer Assembly

· Testing of Printers

Raw Materials

· Electronic & pneumatic components printer assembly and dyes & chemicals for consumable production

Customers and Geography Catered

· We provide our goods and services to a wide range of industries including Personal Care, Food & Beverages, Pharmaceuticals, Construction Materials, Cables, Wires & Pipes, Metals, Automotive & Electronics, Agrochemicals, Chemicals & Petrochemicals amongst others

· Registered office is located at Andheri, Mumbai and branches located at other prominent cities of India such as Delhi, Chandigarh, Kolkata, Jamshedpur, Hyderabad, Chennai, Bengaluru, Colombo (Sri Lanka), Pune and Ahmedabad

· Targeting the markets of Sri Lanka, Nepal and Bangladesh

· Countries to which we export our products are Germany, China, Sri-Lanka, Nepal, and Bangladesh

Subsidiaries

· One wholly-owned subsidiary - LIBERTY CHEMICALS PVT. LTD.

Staff

· 328 sales and service field staff across 13 branch offices in India and Sri Lanka

· The total manpower strength of our Company as of March, 2017 is 665 employees.

· As on March 31, 2017, our sales and marketing team consists of 110 employees

Use of Proceeds

· Primarily for the purpose of capital expenditure for ongoing and future expansion projects, acquisitions, working capital and general corporate purposes

Revenue Breakup

· Income from operations substantially comprises of sale of Printers on outright basis, Printers on Rent and on Cost per Print basis, sale of consumables like Inkjet fluids, Ribbons and Ink-rolls, Annual Maintenance Services

· No Single customer above 5% revenue

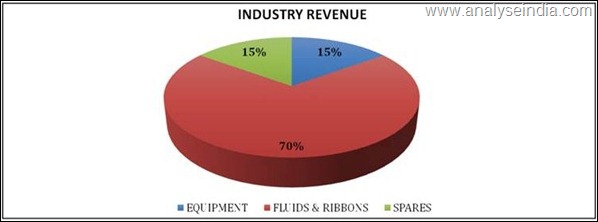

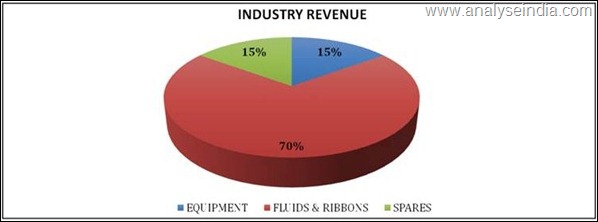

Industry Revenue Breakup

Expenses Breakup

· Expenses comprise of operating expenses, employee benefts expenses, fnance cost, depreciation and amortization and other expenses

· Operating expenses constituted for 40.46%, 39.93% and 41.42% of our total revenue for Fiscal 2017, Fiscal 2016 and Fiscal 2015

· Employee benefit expenses constituted for 18.73%, 19.42% and 18.69% of our total revenue for Fiscal 2017, Fiscal 2016 and Fiscal 2015

· Finance costs accounted for 0.72%, 1.21% and 0.92% of our total revenue for Fiscal 2017, 2016 and 2015

· Depreciation and amortization expenses accounted for 2.69%, 2.13% and 1.87% of our total revenue for the Fiscals 2017, 2016 and 2015

· Other expenses (includes rent and repairs / maintenance of office premises) accounted for 14.55%, 13.85% and 14.93% of our total revenue for Fiscals 2017, 2016 and 2015